A 3.8% Tax on Real Estate Sales? Say it ain’t so!

Have you seen these Google headlines:

- Hidden 3.8% Real Estate Sales Tax in Obamacare Bill

- 3.8% tax on future real estate sales

- New 3.8% tax on real estate sales starting 2013

- Will There really be a Sales Tax on Real Estate

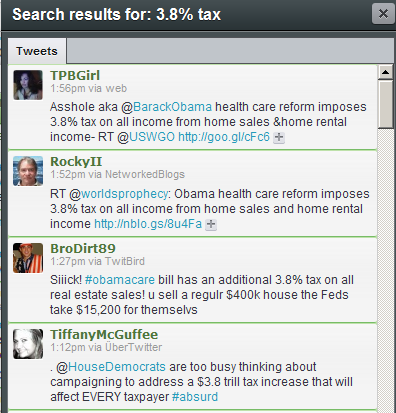

Or, perhaps this in your tweetstream:

The only problem? It just AIN’T so!!

Here are the facts:

- Effective January 1, 2013 there is a new 3.8% tax

- It is not a “sales tax” on all real estate transactions.

- It is a Medicare tax on “net investment income”

- Many people will not have to pay this tax.

So, just who DOES this new tax apply to?

The most definitive answer has to come from the law itself. The law (Public Law 111-152) containing this provision is HR 4872 Health Care and Education Reconciliation Act of 2010. You can download your own copy here.

The Act says:

(a) IN GENERAL.—Except as provided in subsection (e)—

(1) APPLICATION TO INDIVIDUALS.—In the case of an individual,

there is hereby imposed (in addition to any other tax

imposed by this subtitle) for each taxable year a tax equal

to 3.8 percent of the lesser of—

(A) net investment income for such taxable year, or

(B) the excess (if any) of—

(i) the modified adjusted gross income for such

taxable year, over

(ii) the threshold amount.

(b) THRESHOLD AMOUNT.—For purposes of this chapter, the

term ‘threshold amount’ means—

(1) in the case of a taxpayer making a joint return under

section 6013 or a surviving spouse (as defined in section 2(a)),

$250,000,

(2) in the case of a married taxpayer (as defined in section

7703) filing a separate return, 1⁄2 of the dollar amount determined

under paragraph (1), and

(3) in any other case, $200,000.

Net investment income includes capital gains, rents, dividends and interest income. It also comes from some investments in active businesses if the investor is not an active participant in the business. The portion of investment income that is subject both to income tax and the new Medicare tax is the amount of income derived from these sources, reduced by any expenses associated with earning that income. (Hence the term “net” investment income.)

The tax will hit those people whose gross income (roughly speaking, wages plus investment income) exceeds the $200,000 threshold for individuals or $250,000 for couples. But because of how the law is structured, you might not owe the 3.8% tax on all your investment income. Here’s why: the tax would apply to whichever is less — your investment income or the amount that your modified adjusted gross income (AGI) exceeds the high-income threshold.

For example, if adjusted gross income for a single individual is $325,000, then the excess over $200,000 would be $125,000. Assume that this individual’s net investment income is $60,000. The new 3.8% tax applies to the smaller amount. In this example, $60,000 of net investment income is less than the $125,000 excess over the threshold. Thus, in this example, the 3.8% tax is applied to the $60,000.

Now, how does this affect real estate transactions?

Rental Income: Net rental income will be included in “net investment income” and will be subject to the medicare tax if the $200K/$250K income threshold is exceeded.

Sale of Investment Property: Capital gains on the sale of investment property will be included in “net investment income.” The 3.8% tax will apply to amounts exceeding the income threshold.

Sale of primary residence: The $250K/$500K exclusion on the sale of a principal residence will continue to apply. Accordingly, the new 3.8% tax will NOT apply to this excluded amount of the gain.

So, for example, if the taxable gain was $30,000 and a married couple had adjusted gross income, or AGI, (which would include the taxable gain) of $180,000, the 3.8% tax would not apply because AGI is less than $250,000. If that same couple had AGI of $290,000, then the application of the 3.8% tax would be subject to the same formula described above. The $30,000taxable gain on the sale would be less than the $40,000 excess above $250,000 AGI, so the $30,000 gain would be subject to the new 3.8% tax.

Doesn’t all this make you just want to run out and hire a tax pro??

As always, thanks for reading BillOnBusiness.net. Your comments and questions are welcomed below.

Now this is being ahead of the curve on info!

LOL – Thanks Greg!

Thanks for the scoop, Bill!

Oh wow, how confusing are all these bills! I think they deliberately make it confusing so the general public has no idea or think these bills are something they are not. Crazy! Thanks for the info on this Bill! (no pun intended, lol!) 🙂

@Rachel – So true about the confusing part! And many of the provisions of the bill are never really discussed in the public arena – hence they are termed the “hidden surprises” – Thanks for stopping by and reading my blog!